Opportunities in the Chinese education sector and the broader Chinese equity

Tan Nguyen, Analyst | Aug 19, 2021

On Friday, July 23, the Central Office of the Communist Party of China and the Office of the State Council of China issued a document titled “Opinions on Further Reducing the Work Burden of Students and the Burden of Off-campus Training in Compulsory Education” – we will refer to it as “The Opinions” in this blog.

The document includes 30 guiding opinions classified into 8 issues. Among those, 5 key issues are:

– Reduce the total amount and duration of homework for students in an all-round way

– Improve the school system’s after-school services to meet the diverse needs of students

– Adhere to strict governance and comprehensively standardize off-campus training programs

– Vigorously improve the quality of education and teaching to ensure that students learn well in school

– Strengthen supporting governance, enhance support and guarantee capabilities

The full text in Chinese can be viewed on the government’s website: click here

An English translation of the text can be found on Teller Report: click here

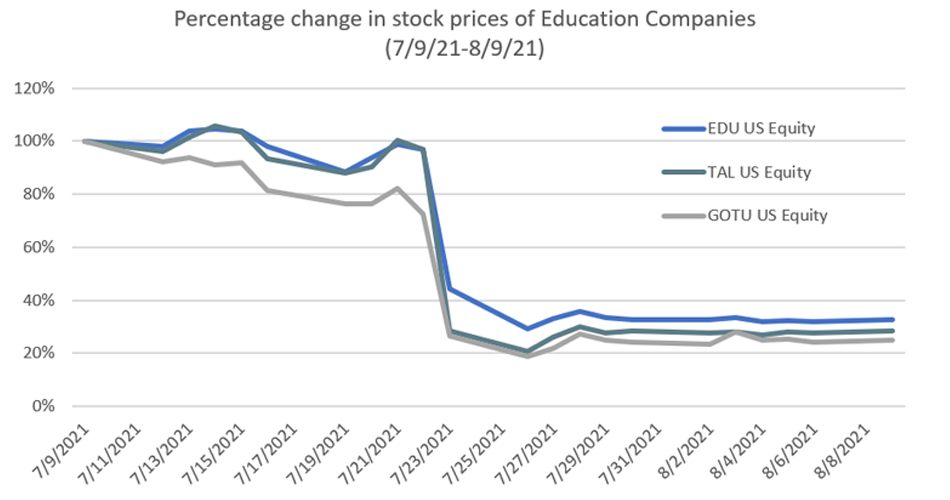

In response to the new regulations, the following Monday, share prices of Chinese and Hong Kong companies plummeted to their lowest levels this year, according to Bloomberg. In the US, the Nasdaq China Golden Dragon index – which includes 98 of China’s largest companies listed in the US – has lost about $750 billion in value since hitting a record high in February 2021.

The stocks that suffered the most with a loss of nearly 70% in value included TAL Education (NYSE: TAL), New Orientation Education (NYSE: EDU) and Gaotu Techedu (NYSE: GOTU). These are the businesses that account for a large share of China’s $120 billion after-school education market.

On Wednesday, July 28, 2021, with the aim of alleviating investors’ anxiety, the China Securities Regulatory Commission (CSRC) vice chairman Fang Xinghai held a meeting with executives from global investment banks such as Credit Suisse, Goldman Sachs, JPMorgan and UBS. According to Reuters, at the meeting, Fang told the leaders of the banks that “official policies would be rolled out more steadily to avoid sharp volatility in the markets,” and he also indicated “the crackdown was not aimed at decoupling Sino-U.S. financial markets.”[i]

In this blog, we would like to unpack the situations in both Chinese education sector and broader Chinese equity, which in our opinion may present some interesting investment opportunities.

On Chinese education sector…

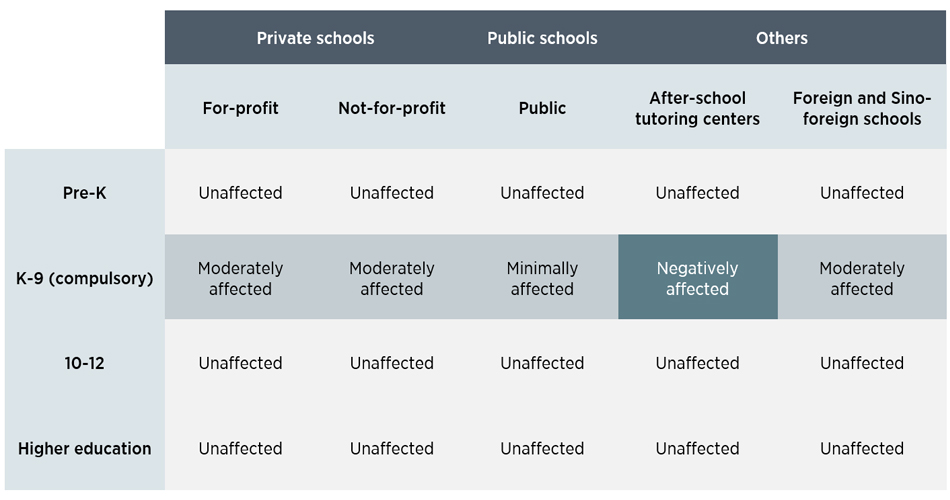

First, the recently published Opinions only address the Compulsory education segment, which is K-9. The Chinese education system can be divided by age into the following segments: Pre-K, K-9, 10-12, and higher education – university, graduate, vocational and others. The Chinese Communist Party (“CCP”) has made K-9 compulsory education, which is available to students for free in public schools.

Second, when we examine the various clauses in the Opinions, it becomes clear that the primary targets of this regulatory round are the after-school tutoring centers, the likes of EDU, TAL and GOTU. The rest of the education system is either moderately affected – those schools which provide traditional K-9 education services, or not affected at all – those which service non-K-9 segments, like Pre-K, 10-12 and higher education.

In the following table, we categorize the Chinese education businesses into private schools, public schools and others (tutoring centers, foreign and Sino-foreign schools). Private schools can be further categorized as For-Profit or Not-For-Profit, where the main distinction is whether they are allowed to distribute profits to their owners.

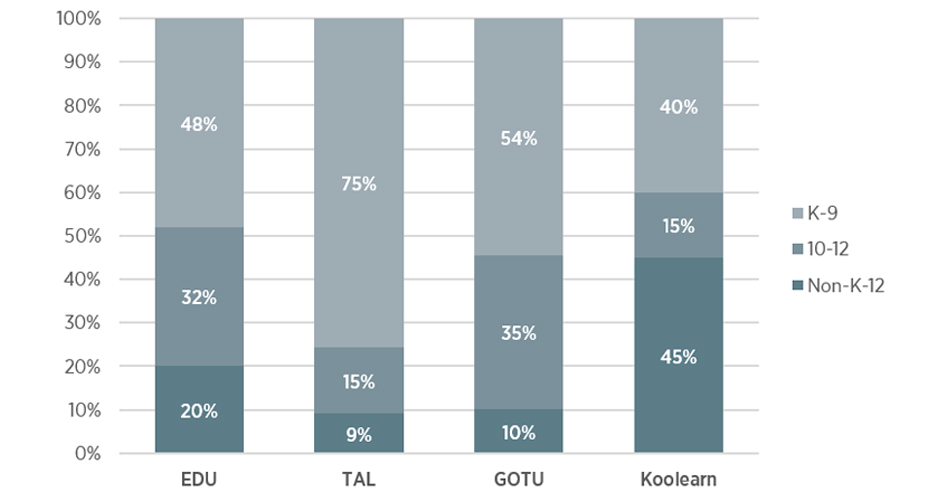

Third, according to Bloomberg, there are about 80 education companies listed in Greater China, many of which derive most of their revenues from the non-tutoring and non-K-9 segments. Some companies offer primarily 10-12 or higher education. Other companies offer traditional K-12 education, but they structure their K-9 core education as not-for-profit and derive their profits within the K-9 segment through licensing and consulting services, allowing them to remit a portion of student tuitions to their investors. These companies are not directly impacted by the recently published Opinions. In fact, the management teams of these companies have even publicly announced that the current regulations have very little bearings on their businesses. Alas, much to their bewilderment – and our amusement – some of them were sold off with the rest of the sector. It is possible that the sell-off reflected not only the impact of the latest regulations but also the overall risks of investing in Chinese education companies. In our opinion, those risks have existed for years and investors historically overacted to new regulations in this space and then, after a couple of years, underestimated those risks as some education companies continued to deliver outsized profits. Therein lies some attractive investment opportunities for patient investors, which we are happily exploring. We will discuss those investments and a similar situation in 2016-2017, where many companies in the education industry were unjustly sold off, in another article.

Fourth, some companies like EDU generate more than half of their revenues from non-K-9 businesses, which are not affected by the current regulations. We believe there is heterogeneity in the degrees of financial impact even among the after-school tutoring companies.

Last but not least, there is a perception that the Chinese government does not want private investments in the education sector. This perception is based on the Clause 13 in the Opinions, which requires that all subject-based training institutions in the compulsory segment (K-9) be registered as non-profit institutions. While this may come as a surprise to many, the K-9 segment in China has always been non-profit since November 2017. The official laws, which promulgated such non-profit requirement, were published by the Standing Committee of National People’s Congress (“NPC”) in late 2016[ii]. In the same document, the NPC legalized “for-profit” private schools in an effort to encourage private investments in the education sector. The Chinese government recognizes the role of private schools and encourages their developments outside of the subject-based, compulsory segments.

On the broader Chinese equity…

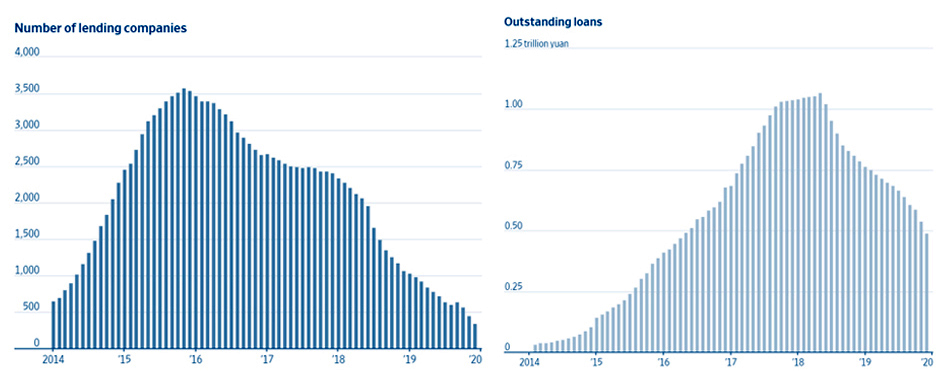

This is not the first time the Chinese government has taken drastic actions to redress a sector which is led astray by market forces. As recent as in 2018, the government dealt a severe blow to the Peer-To-Peer (“P2P”) lending industry, following a wave of protests by P2P investors who lost their money when the P2P platforms couldn’t pay them back. The government initiated a series of stringent regulations, including new registration requirements. Police arrested owners and staff of several P2P lenders. Eventually, the number of P2P platforms dropped from more than 3500 at the peak in 2016 to less than 400 in 2020. The outstanding loans decreased from more than RMB 1T in 2018 to less than RMB 0.5T in 2020. Although the magnitude of the crackdown was smaller because the P2P companies were not big, many companies that were listed in the U.S. in 2016-2018 lost most of their market values in subsequent years. Examples include Yirendai (NYSE: YRD) losing 90% of its valuation from the peak to end of 2018, and Qudian (NYSE: QD) down 87%. The better companies, like Lufax (NYSE: LU) and LexinFintech (NASDAQ: LX) did come out with stronger prospects; however, due to the recent clampdown on Ant Financial, their share prices have remained choppy.

Compared to the P2P episode, the current crackdown on the Chinese education companies harbors two key differences, which have led to a broader sell-off in Chinese stocks.

The first is there was a specific clause in the recently published Opinions which talked about foreign ownership restrictions, which raises the perennial question on the legitimacy of the VIE structure. Based on the texts of the published Opinions, the foreign ownership restriction is primarily to curb foreign investments in the subject-based programs in the K-9 segment. As we have explained above, the K-9 segment has always been required to be non-profit since November 2017. Therefore, it is our view that the restriction is mainly to stop the aspiring, new education companies from listing overseas and bypassing such nonprofit restrictions. We don’t believe that this has anything to do with the VIE structure. Nor does it have anything to do with the government’s view on private investments in the education sector.

The second is the education regulations came out amidst a series of crackdowns by the Chinese government on the tech sector – from anti-monopoly on Alibaba, Tencent to data cybersecurity on Didi to worker protection requirement on Meituan. Investors have been anxious and tired for quite some time trying to cope with Beijing. The crackdown on the education sector was probably the straw that broke the camel’s back.

Here, we believe it is important to understand the broader contexts in China’s sociopolitical environment. This year marks the 100th year anniversary of the Chinese Communist Party (CCP). Despite its enormous success in the last 100 years – particularly in the last 3 decades – the CCP has faced serious criticisms on several fronts, the chiefs of which are 1) poor quality of economic growth and 2) China’s role in the world.

On the first point, China’s 30-year economic miracle has been accompanied with multiple issues including inequality, environmental degradation (and health-related consequences), and fragility in the financial sector due to leverage. To redress such problems, the CCP has been more serious about achieving a more balanced, equitable economic development. Companies and entities which don’t promote such mandates have come under fire from the CCP, especially when the CCP needs to have something to show for their 100th anniversary.

On the second point, despite being the 2nd largest economy in the world, China’s political influence in the international community is nowhere close to its economic standing. From the Chinese people’s perspective, China has been bullied by the developed, particularly Western, world. The rise of China is not taken well by the existing hegemony, i.e., the US. In fact, in the history of mankind, whenever there is a rising threat to an existing hegemony, there have been political, economic, and most often military clashes. The tension between China and the US (and its allies) will likely mean several things. One is that China will strive for more economic independence from its Western counterparts. Two is that there will be misleading & combustible media attacks on both sides. However, in none of these scenarios do we see China shortchange the global markets for its benefits.

It is our view that the CCP does not wish to benefit themselves at the expense of foreign investors. In fact, the Chinese economy is deeply integrated with the global economy that it is in China’s best interest to make sure the other economies do well. Furthermore, the total market cap of Chinese companies which are listed abroad is $3-5T, or more than a quarter of China’s GDP. It does not benefit China to send a shockwave through the global financial market by being unpredictable or unreasonable.

Next steps

Our current exposure in Chinese companies is now more than 18% and we are still looking to increase our exposure.

Our investment theses on Chinese companies hinge on three pillars. Firstly, these companies are wonderful enterprises with durable advantages and honest, capable management teams. Secondly, China will behave in a manner which is fair to foreign investors. Lastly, the valuations of these companies provide sufficient downside protection even in the worst case, while presenting enormous upside potentials.

In the subsequent blogs, we will provide in-depth analyses on our individual Chinese holdings.

[i] China to allow for-profit schools, except in compulsory education (hoganlovells.com): https://www.hoganlovells.com/en/publications/china-to-allow-for-profit-schools-except-in-compulsory-education

[ii] China’s efforts to calm investor jitters help markets rebound | Reuters: https://www.reuters.com/world/asia-pacific/china-regulator-talks-investment-banks-calm-market-jitters-sources-2021-07-29/